Efficient Investing with the Three Fund Portfolio

I spent too much time early in my career trying to beat the market. I read a bunch of investment books and scoured the internet for trading tips. After all that work, my results were only mediocre. I wanted a to find a shortcut – investments that would make me a millionaire overnight. But more risk does not always come with more reward. I’ve found that the best way to invest is with a boring, yet highly effective and efficient Three Fund Portfolio.

Buying solid investments for the long term.

Buying solid investments for the long term.

What is the Three Fund Portfolio?

The Three Fund Portfolio is a simple strategy to diversify across three broad asset classes. These include the US Total Stock Market, International Total Stock Market, and Total Bond Market. The portfolio can easily be created using low cost index funds which are now available with almost any brokerage company.

The total market index funds are diversified across the entire stock market and include a sampling of all companies, both large and small. The S&P500 for example is made up of the 500 largest US companies, whereas the Total Stock Market index fund is comprised of approximately 3,600 companies. It’s basically a slice of the entire US stock market.

The funds are cap weighted, meaning they own a portion of a company based on its value or market capitalization. If you had one company that was worth $10 billion and another worth $50 billion, you would end up owning 5 times more of the bigger company. For this reason the top 10 largest companies make up around 16% of the total market index fund.

It’s good to diversify.

It’s good to diversify.

The Three Fund Portfolio saves time

Investing in individual stocks can be a job in itself. If you want to have good diversification, you will be buying dozens if not hundreds of individual stocks. The fortunes and prospects for these companies can change day to day. You need to track the performance outlook of each investment on a regular basis. Basically you end up doing the work of a mutual fund manager.

I’m not interested in being a fund manager. I want to spend my time fishing, surfing, brewing beer, gardening, raising chickens, tinkering, and even chopping firewood. I’ve spent enough time in front of a computer doing research, and it’s the last thing I want to do in retirement.

The Three Fund Portfolio is low stress

Stress can easily encompass the mind, following you around and occupying mental bandwidth. The market is unpredictable and volatile. I don’t want to stress about whether I chose the right stocks to buy while I’m on vacation. I’ve been there and it sucks. Just like I don’t want my body trapped in a cubicle, I don’t want my mind trapped by needless stress.

When investing with a Three Fund Portfolio, I know I’m diversified across all markets. I own a stake in every major company, including bread and butter companies that feed and clothe us as well as the new and exciting companies that are forging our future.

I don’t want investment anxiety occupying my mind.

I don’t want investment anxiety occupying my mind.

With the Three Fund Portfolio, there is nothing more I can do, or need to do. In fact, the best thing to do is relax, ignore the news, and enjoy life. The highly educated, and highly paid CEOs and managers of the world are worrying about my investments for me.

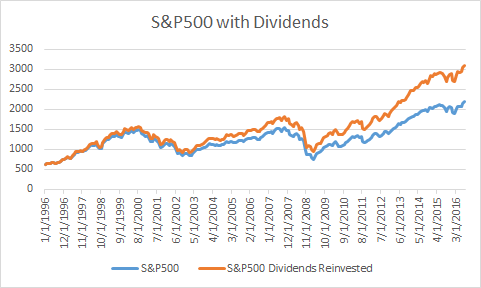

The Three Fund Portfolio is effective

As hard as they try, the majority of mutual fund managers and hedge fund managers can’t beat the market, especially when you account for their fees. Maybe I could do marginally better than the market through researching and buying solid investments. But if I wanted to sit in front of a computer for more money, I could get better returns going back to work as an engineer.

While you have a chance of beating the market with individual stocks, you are also taking on more risk. And more risk doesn’t always mean more reward, only that more reward is possible. It’s also quite possible you will under perform the market. If you count the cost of your own time, then you are looking at a less attractive proposition.

It’s hard to beat the index.

It’s hard to beat the index.

A Three Fund Portfolio is tax efficient

Index funds are very tax efficient because they only trade stocks as they enter and leave the minimum market cap. This means, when they are selling a stock, it’s on its way down, and in some cases the sale might even be at a loss. Usually any capital gains from selling can be offset with those capital losses. For this reason, the Vanguard Total Stock Market Index Fund has distributed zero capital gains to investors in over a decade. It’s almost like free built-in tax loss harvesting as they sell the losers and replace them with winners. As long as you leave the money invested, you only pay taxes on dividends, not growth.

US companies do business internationally, do I need international stocks?

The US stock market has crushed the international stock market over the last 10 years. But this wasn’t always the case, there have been many times where the international stock market has outperformed the US stock market.

The Three Fund Portfolio is all about reducing risk and optimizing gains through diversification. We buy the Total Stock Market index fund because it contains both large and small companies. This is because often times the small cap companies outperform the large cap companies like those in the S&P500. The same logic applies to purchasing the Total International Stock Market index fund.

You never know when the US stock market might under-perform, and right now it’s had a massive run up. The PE ratio for the US Total Stock Market index is 24.1 and the PE ratio for the International Stock Market index is 21.1 suggesting better value in international stocks. It’s not a big portion of our portfolio, but we do like having some international exposure.

How should I balance my Three Fund Portfolio mix?

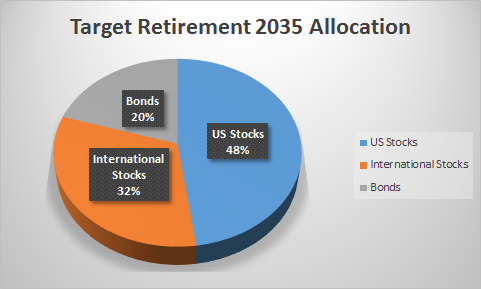

The balance between the asset classes in the Three Fund Portfolio are going to be different for everyone. This can depend on things like your risk tolerance and how many years you have until retirement. A good place to start is by choosing a Vanguard Target Retirement fund based on your expected retirement date and take a look at its holdings. It’s not surprising to see that the Target date retirement funds are made up of US and International stocks and bonds – kinda like a three fund portfolio.

Target retirement fund allocations can give a good starting point.

Target retirement fund allocations can give a good starting point.

Simply buying target retirement funds is in fact an excellent option. However, the fees are slightly higher, and you might want to balance your three fund portfolio across multiple accounts. The interest from bonds is taxed at the higher income tax rate whereas the stocks are taxed at the lower capital gains rate. For optimal tax efficiency, you can keep your bond allocation in your tax advantaged 401k. Then only keep stocks in your after tax brokerage account.

The Three Fund Portfolio works

While I still use a few other investment vehicles, the Three Fund Portfolio has done most of the heavy lifting on our journey to financial independence. I still like to read up on investing and search for better returns, but I always come back to the same conclusion. It’s hard to beat the efficient, effective, low maintenance, and stress-free Three Fund Portfolio.