How to Retire Early, It's About the Early Retirement Lifestyle

Make sure to take in the scenery on your journey to FI

Make sure to take in the scenery on your journey to FI

The key to achieving financial independence is developing your own early retirement lifestyle. People get the impression that in order to live cheaply, you have to be a deprived hermit. They go on a financial diet in hopes that one day they will be financially free and the sheer bliss will outweigh all the years of suffering. But just like a diet, depriving yourself will only be tolerable for a small period of time before you relapse.

The journey to financial independence is a long one, and life is short. I would not recommend anyone make themselves miserable for decades of their best years with the hope things will be better one day. Having an early retirement lifestyle doesn’t mean depriving yourself, it just means leading a more exciting and fulfilling life that is not dependent on spending large sums of cash. Instead of living in a cardboard box eating ramen to save money, one should pursue financial independence by honing a lifestyle that is based on living well for less.

The Basics Behind Early Retirement

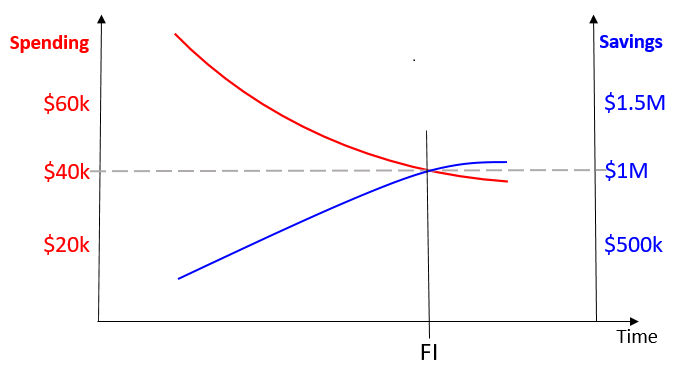

At its basics, financial independence means you have enough assets generating income to support your lifestyle without needing supplemental income. There are many different types of investments, but If you are investing mostly in stocks, the 4% rule based on the trinity study is a useful standard. The rule basically says that over the existence of the US stock market, you could have withdrawn 4% of your portfolio every year without the portfolio ever running out. This means that if you are spending $40,000 a year, you need 25X that amount or $1 million to retire. If you are spending $20,000 a year, then you only need $500,000.

Financial Independence: When spending intersects passive income

Financial Independence: When spending intersects passive income

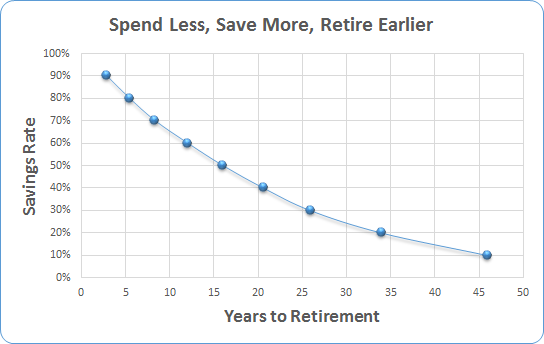

There are two ways you can speed up your journey to financial independence: increasing income and decreasing spending. If you are living off of 50% and saving 50% of your income, then you are saving 1X your spending a year. With 6% compounding interest on those 1X savings, you are looking at reaching financial independence in only 16 years. If you have a 75% savings rate, you can retire in as little as 7 years.

Years to retirement based on savings rates, assuming 6% return

Work Toward a Good Salary

Step 1 is get a good job. I recommend anyone getting ready for college to explore what your options are for employment once your are finished. If you have a job, don’t remain complacent. It’s sad but true that only the squeaky wheel gets the grease at many companies. That doesn’t mean you should become a whiner – you should keep learning, and make yourself into a valuable asset so you have leverage when asking for raises. Always keep an eye out for other opportunities and consider switching to a new job that pays well even if you have to move.

Set Your Spending By Funding Your Retirement First

In this game, it’s all about what you keep, not what you make. Humans are lucky to have an incredible gift of adaptability. When we are hit with a disaster, we still have the ability to adapt and learn to be happy under new circumstances. The problem is that this is also true with having more money. As our salary increases, so do our tastes and needs. We become acclimated to a lifestyle, then need more and more to stay satiated. The key to financial independence is making those salary increases invisible to ourselves.

Set a savings goal and have funds withdrawn from your paycheck through automatic contributions to your 401k. If you have a good salary, you should easily be able to max out your pre-tax 401k. If you are in the 30% tax bracket, contributing to your pre-tax account means saving 43% more than if you contribute the same amount after tax. Once you max out your tax-advantaged retirement accounts, setup automatic withdrawals to an investment account such as Vanguard. Your goal should be to maximize your overall savings rate.

If you don’t feel like budgeting, then screw it. If you’re already busy and don’t enjoy it, you’ll never make time to do it. All you need to do is adapt your spending to the cash flow that remains after your savings. Be conscious of every purchase (don’t just buy stuff), and keep an eye on your overall bills and spending for each month. It can be helpful to look over your credit card statements at the end of the month to see where your money went, then adjust accordingly. The goal is to continuously cut excess spending while building your own early retirement lifestyle that doesn’t depend on tons of cash for happiness.

Optimize Recurring Expenses

Housing and vehicles are usually the largest recurring expenses. Try to rent close to where you work so you don’t have to drive. When you rent, make sure that the monthly payment is a reasonable portion of your salary, and consider having roommates. Before I was married, I had roommates to help pay my rent, then my mortgage. Some of those roommates ended up being my best friends. If you want to buy a home, spend less than half of what you can afford.

A nice dependable car should cost you less than $5,000. We found both of our $5,000 vehicles on Craigslist and paid cash. They are dependable, and since we can replace them with cash, we don’t need to carry comprehensive or collision insurance. New vehicles are a huge expense. If you are in the 30% tax bracket, a $400 car payment could be $571 contributed to your 401k every month or $6,857 a year – that’s more than 1/3 of what you need to max it out.

When I got my first job, I made the mistake of buying a brand new RSX Type-S. It only took me a few months to realize it was just a car getting me from point A to point B. I sold it and replaced it with a cheap Civic. Recently I calculated that the decision to eliminate my car payment years ago made a difference of $70,000 in our current net worth.

Lightning – Our $5,000 Prius

Lightning – Our $5,000 Prius

Cut the cord on your cable and just buy internet. There are plenty of cheap streaming services with more than enough content to watch. A big benefit of eliminating traditional cable and going to a streaming service is the elimination of commercials. You don’t need to give any of your free time to marketers who are trying to make you spend more money.

Hone an Early Retirement Lifestyle That Maximizes Happiness Per Dollar

Much of our happiness is drawn from doing fulfilling things that involve the passions in our lives. These passions are the most important part of defining what your early retirement lifestyle should look like, and it’s different for everyone.

Whether it’s caring for family, enjoying good food, pursuing hobbies, or fighting for your ideals, you shouldn’t be afraid of putting your money where your heart is. But make sure you are getting the best bang for your buck. Too often we throw money at things because they are important to us without weighing our return on investment.

When it comes to family, we can easily spend money on crap like tons of holiday gifts. But the excitement is short lived and theses gifts end up burdening our loved ones with material junk they will feel bad about donating or selling in the future. Making memories by simply sharing a home cooked meal or activities can have a more meaningful impact on relationships. It’s easy to make the excuse of keeping family safe by spending money on new cars and big homes in expensive neighborhoods, but the increase in safety is marginal and comes at the cost of time. You will probably get more bang for your buck by spending less time at the office and being present to care for your family.

Find Your Early Retirement Hobbies

When it comes to hobbies, there are plenty that don’t cost much. By choosing ones that involve things you love, you can learn new skills that will upgrade your lifestyle. If you love good food and entertainment, then learn to cook and host friends to enjoy your meals. Take some time to gain a new skill like making pizza or fresh pasta, or maybe even learn to brew beer. Not only will you save money, but you will also be able to enjoy these things even more fully when you know what goes into creating a good product – this is the path to becoming a true connoisseur.

Pizza at home

Pizza at home

If you are lacking hobbies or they simply do not fit into an early retirement lifestyle, make some effort to try something new. There are plenty of great hobbies that can be done without much investment, and one day they could even become your retirement gig. Every time you learn to enjoy cheap new hobbies, you are adding to your early retirement lifestyle skill set. Some cheap hobbies I enjoy include, fishing, hiking, sailing, brewing, gardening, writing, biking, cooking, and cutting firewood.

Upgrade Your Skills, Not Your Equipment

Watch your spending with hobbies – do not go out and buy all the fancy gear. Instead, work on your skills. In hobbies that fit an early retirement lifestyle, it’s the skill of the hobbyist that will reflect superior results. One of my favorite guitarists, Jack White, has a penchant for cheap guitars and makes incredible music you could never replicate just by spending $10k on a guitar. Learn your hobbies with the basic tools – don’t try to shortcut lack of skill with cash. Becoming good at something doesn’t mean buying fancy gear and gadgets.

If you enjoy travel, look into reducing costs. We never choose one destination where we have to go. Instead, we are always open to several destinations and simply go where it’s most affordable at the time. Look into travel hacking – on our trip to Colorado, we actually made $1000. And our road trip through Nova Scotia and Maine cost us less than $100/day. We even hacked a $6,000 all inclusive vacation for free. The less money you spend on these things, the more you can do.

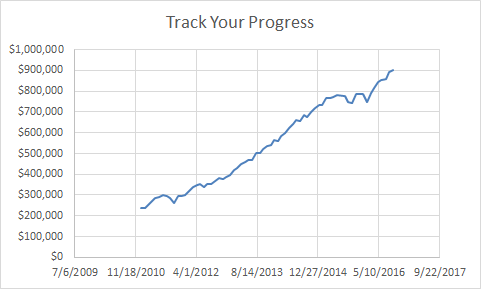

Track Your Progress to Early Retirement

No matter how you try and crunch it, financial independence is a long journey. Keep on course by tracking your net worth. We like to add up our retirement and investment accounts on a monthly basis, and are always excited to see where we ended up. It’s a great way to keep motivated on the journey. You can celebrate hitting big milestones, or get reinvigorated to try harder when you see setbacks. Monthly or annual checkups are also a great time to see how your investments are doing. Are your allocations the way you want them? Are you optimizing your investments to minimize taxes?

Stay engaged with monthly checkups on investments

Get Your Own Crazy Kicks

If you follow these steps, you will feel the burden and stress related to your job start to lift. The realization that your well-being is not dependent on your job is liberating. The larger your savings become, the less you have to stress about climbing corporate ladders and increasing your salary. You can pursue projects that you enjoy working on versus ones that stress you out. Maybe you can also secure a work from home or part time work arrangement. Maybe you start wearing jeans and funny looking sneakers to work, or grow your hair out and learn to surf – whatever floats your boat.

Perhaps one of your early retirement lifestyle hobbies or passions will take you in an entirely new direction. Having a good spending level makes it easy to pursue the things you love without having to worry about money. Mrs. CK left her corporate job to teach at a community college. She loves the new job (and having summers off) and it’s been fulfilling for her to teach new students every semester. Because our spending was at the right level, we didn’t have to think twice about taking a six figure pay cut. Maybe your early retirement lifestyle will lead you to an early retirement job as well.

Start Living Your Early Retirement Lifestyle Now

Developing your lifestyle is the key to early retirement because that’s how you are going to live your entire life. Even if you do pull off the dull life of a hermit who spends no money, is that the type of life you want to maintain in retirement? You won’t have any more money than what you were spending before. Even if your plans are to move elsewhere and start a new life, what are your hobbies going to be? What will you do for fun?

Don’t wait until retirement. Start living your early retirement life now. Your early retirement lifestyle will not only make your journey fulfilling, but you will arrive at your early retirement destination prepared to enjoy your freedom to the fullest.