Should I Pay off My Student Loan Debt?

A lot of people think you should always work to eliminate debt. While this is a solid approach for high interest debt, paying off low interest student loan debt could significantly slow your portfolio’s growth. I decided not to pay off my student loans, and invested instead. While investing was a better choice for me, some of us are more risk averse, and we each need to find the right balance for ourselves. Before we make any decisions, it’s important to compare the numbers and consider the risks.

You may have heard of the concept of homo economicus, a simplified economic model of us humans. It assumes that people behave in a rational way, always looking out for self-interest by making the most optimal financial decisions. But we’re a bit more complicated than that.

In reality, I feel like I fall between two diametrically opposing models. Let’s call them homo Chickenus, and homo Sharkinus. Sharkinus is a lot like homo economicus, it’s always trying to maximize value, and doesn’t mind taking on risk. Chickenus on the other hand, wants to make decisions based on emotion, and is also much more risk averse.

Some of us are born with a little more Sharkinus (like Mrs CK), and some have a little more Chickenus (like me). We all have varying appetites for risk, but we can usually bring Chickenus and Sharkinus into closer agreement by analyzing risks and potential returns.

The utility of debt

As horrible as some people think debt is, it can be a useful tool. We expect companies to retain a healthy amount of debt, because they use loans to buy more equipment, hire more workers, and earn more profits. By growing and commanding more market share, these companies become more valuable with debt than without it.

This can hold true on an individual level. I paid a good portion of my way through college working as a landscaper, but I also had to take on debt. After graduating, I had approximately $16k in student loans. But I was also equipped with new skills that allowed me to make more money than I did landscaping.

If we’re using it as a tool for increasing value, Sharkinus has no problem taking on debt. Chickenus on the other hand, isn’t happy with the monthly payments.

Is there value to paying off student loan debt?

Once I graduated, I started getting some decent paychecks. After paying the bills, I had some extra cash to pay off student loan debt or invest. Right off the bat my Chickenus and Sharkinus were in disagreement.

Sharkinus points to the business aspect, “We should invest the money for larger returns, and maybe even take a bite out of some more debt to keep growing!” Meanwhile Chickenus is getting stressed out. “But we’re in debt! What if we lose the job and still owe money?”

They both have good points, but before letting either of them run wild, it’s worth running the numbers.

Is your student loan tax deductible?

Before you decide whether to pay off student loan debt or invest, it’s important to know what your student loan is costing you. The effective interest rate might be a bit lower if it’s tax deductible.

At the time of writing this article, the IRS allows student loan interest deductions up to $2,500. This deduction is only available for certain income ranges, and you can check with the IRS website to see if you qualify.

If you do qualify for a deduction, this could mean paying 10-20% less than if you had to pay with after tax money. The effective rate you pay on your loan would be reduced by the same amount. We want to account for that when comparing investment returns with your loan’s interest rates.

Can you refinance?

The lower the interest rate on a loan, the less we get out of paying it off. When I first graduated from school, the interest rate on my loan was 3.5%. After making my payments on time for 2 years, I was able to refinance my loan at 1.6%.

Checking to see if you can get a better rate is one thing that both Chickenus and Sharkinus agree on.

Don’t forget, inflation is working for you

While Chickenus is always thinking about how debt is bad, Sharkinus is thinking about how low interest debt can increase value. “Consider a student loan charging 1% interest. With inflation at around 2%, we’d be coming out ahead 1% each year, just by only paying the interest!”

Of course, to really come out ahead, you also have to invest the money that would otherwise have gone toward paying off the student loan debt. And those investments need to return more than what your debt is costing.

What kind of returns could you get instead?

If you just wanted to beat inflation, you could invest in TIPS (Treasury Inflation Protected Securities.) These bonds track inflation, and are pretty much guaranteed returns since they’re backed by the US government. In the case that a student loan is less than 2%, it might be better to invest in TIPS.

Chickenus does like the idea of guaranteed returns. “Maybe we can invest in government bonds over paying off super low interest student loans.” But Sharkinus still isn’t happy. “That’s a start, but we can get even better returns in the stock market.”

When it comes to stock and bond investments, we use a 4% rule to determine safe withdrawal rates for early retirement. This tells how much we can expect a portfolio to provide us based on historical worst case scenarios. But the studies behind the 4% rule use real returns, meaning that inflation is already accounted for. This is so that you can increase your withdrawals each year with inflation to maintain a standard of living.

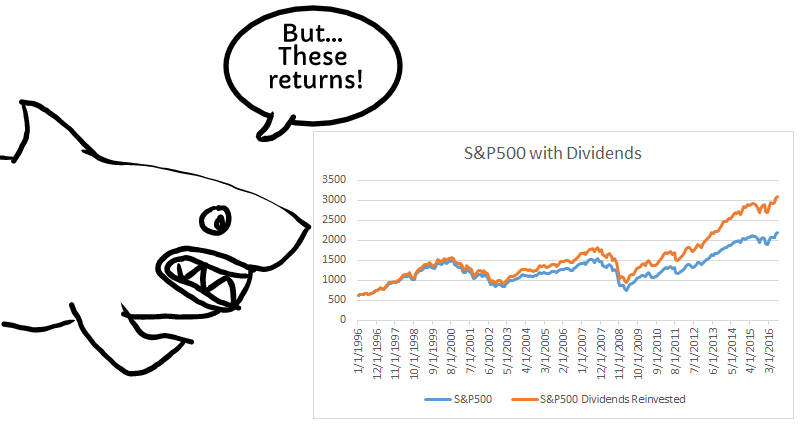

If we weren’t accounting for inflation, we could expect investment returns closer to 6% based on historical worst case scenarios. And if we look at the averages, the stock market has returned closer to 10% throughout history. I invest in basic index funds, and at the time of writing this article, the Total Stock Market Index Fund has a 10 year return of 7.7%.

Sharkinus would be quick to remind us, “If you invested 10 years ago, it would have been right before the massive stock market crash of 2008… And even with that terrible timing, you would have earned 7.7% on average 10 years later!”

So should I pay off my student loan?

Well, even Chickenus is now OK with keeping the super low interest student loans, let’s say below 2%, because there are options for guaranteed greater returns. Sharkinus however, wants to invest the money before paying anything less than 6%, and still wants to take on even more debt. “We’ve run the numbers, you’re pretty much guaranteed to make more money in the stock market over the long haul.”

Even though I’ve looked at the numbers myself, 6% is sounding like a pretty high interest rate. I get that Sharkinus wants to clear extra profits, but I’m not sure it’s worth the extra risk. And even for a growing company, there is a limit to what is considered a healthy amount of debt. On the other hand, I do think Chickenus might be costing us some money by being a little too, umm… chicken.

Can you make pre-tax contributions to a retirement account?

Many of us have the option of investing in pre-tax retirement accounts like the 401k. Depending on your tax bracket, investing in a pre-tax retirement account can mean saving 20-30% on taxes you would have paid on the contributions. And if you plan on retiring early, you may never have to pay those taxes. That’s an enormous advantage to investing that you get right off the bat.

Both Sharkinus and Chickenus can agree on paying less taxes than we need to.

Consider investing while paying down student loan debt

While Sharkinus would like to have a portfolio allocation of 100% stocks, a lot of us still appease Chickenus by keeping some portion of bonds. That way, we can still get good returns, and Chickenus will let us sleep at night. We can do a similar split with our student loan repayments.

If you normally invest 75% stocks and 25% bonds, you could consider continuing investing 75% in stocks, and then put the 25% towards debt rather than bonds. The Total Bond Market index fund is only returning 2.3% at the time of this article. And it’s more important to have time in the market with your stock investments.

Fighting the temptation to pay off student loans

Even though I already quit my job, I still have student loan debt. The rate is 1.6%, and I just checked my balance – I owe $1,500.

While all the beasts in my head agree this is student loan debt worth keeping, Chickenus is still really tempted to just pay it off. Mostly because it would feel so good to eliminate the payments. But we all came to an agreement years ago, and it’s been working out well. My portfolio has doubled in value since I started investing, making me about $15k richer than if I had paid off my student loan.

My decision was pretty easy though. Paying off a student loan with such a low rate was something everyone could get on board with. If you still have debt in the 2-6% range, you should figure out how to appease your own Sharkinus and Chickenus.

You don’t want to side 100% with Sharkinus if you might be swayed by Chickenus to sell stocks when the market tanks. That’s why it’s important to pick a strategy and stick with it. The best answer is probably going to be somewhere in between what our Sharkinus and Chickenus want us to do.