What I Would Do With Your Money

One of my best friends and I met when we were both interns at the same company. I ended up spending over a decade of my life there, while he moved on to bigger and better things. Much like the relationship I have with my wife, nothing is a secret between us, and no punches are held. Over beers, I will lecture him about his finances, in turn he will forcibly treat me to overpriced tacos that have been handcrafted by some tatted up kid with a man bun.

My good friend Lorenzo de’ Medici with a piece from his collection.

My good friend Lorenzo de’ Medici with a piece from his collection.

He is a connoisseur of fine art, modern cuisine, and finely aged booze. Much like the Medici family and their patronage during the Renaissance, he is a patron of Philadelphia’s hipster renaissance. So to protect his identity, I will refer to him as Lorenzo de’ Medici.

I have a secret motive for Lorenzo – nothing would please me more than for my good friend to be able to quit his job early and have more time to hang out. Once, I tricked him into showing me his 401k, then stole his laptop and maxed out his contributions. It may have cost him a few pork belly banh mi tacos, but somehow he managed to survive despite the missing wages. In fact, he has been doing so well that he recently let me know that he had a good amount of extra cash saved up. In a brief conversation, he even suggested he might consider investing it, but in what?

While I love to preach the good word of financial independence, I get nervous about giving investing advice. Most people still have a gambler’s mentality about the market. You need to get in, buy low, and sell high – take your winnings and run for the hills. If you try to time the market like that, then you are indeed gambling. If I tell my good friend to buy into an index fund there is a possibility that it could go down next year, maybe even by a lot, and I don’t want to feel responsible for his anguish.

So Lorenzo – I know you are reading this – the only way for me to unburden myself from future blame, is to make a case for you to do your own investing. It’s easy, and there’s lots of money to be made. However, I want you to understand exactly what you are getting into.

First of all, you have to be in for the long haul.

If we are going to invest your money, we have to agree that you will not pull out your investments just because you feel some pain. The market keeps going up overall as the economy grows, but there will always be ups and downs – you will have to be committed to staying the course. If you can’t handle a 50% drop in the value of you assets, then you have no business investing in the stock market. You should be good here, you are a wealthy man, and I know you can handle a 50% hit. Let’s treat this investment like a museum piece – you can look but you can’t touch.

Diversification is key – let’s just buy you one of everything.

If I were to commandeer your laptop again, I would open up a Vanguard account for you and invest all of that extra savings into the Total Stock Market Index Fund. It’s as simple as that – buy that one fund. You already have bonds in your 401k and shouldn’t have them in your brokerage account for tax reasons. Capital gains taxes are very low and apply to US stocks, whereas bond earnings count the same as income.

Similar to the S&P500, this is a market cap weighted index fund. If you take a company’s share price and figure out how much it would cost to buy up all the shares, that is the company’s value or market cap. An S&P500 index fund, at its basics, takes the largest 500 companies and buys a portion of them based on their market cap. If you had one company that was worth $10 billion and another worth $50 billion, you would end up owning 5 times more of the bigger company. For this reason the top 10 largest companies make up around 19% of an S&P500 index fund.

The Total Stock Market Index Fund is also cap weighted, but instead of just the big guys, it also has smaller companies. Instead of just 500, it holds something more like 3,600 companies. Being a generous patron, I know you want to own all those small businesses as well. But even though you will own all the small stuff, this is a market cap weighted index, and the same top 10 largest companies still make up a good portion – around 16% – of the fund. So in many ways, this fund still acts a lot like the S&P500.

When you buy the Total Stock Market Index Fund you get a sampling of everything that is out there. You will become an owner of all of America’s greatest companies such as Facebook, Amazon, Microsoft, Berkshire Hathaway, Tesla, and even Apple – I know you like Apple. When they profit, they can invest that money back into the business making your investment more valuable, or they might give you your cut in the form of a dividend payment. So when a hipster buys another MacBook Air, some fraction of the profit Apple makes will come back to you in a dividend payment. In turn, you buy some Brussels sprout tacos, and the circle of life continues.

Make sure you’re accounting for those dividends.

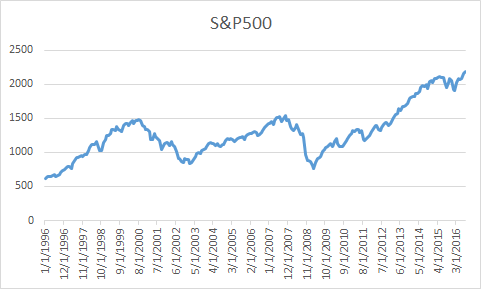

By now, you probably have googled the S&P500 price charts. Admittedly, they might not look super awesome. I mean look at that crap – if you invested in 2000, you would have less money 10 years later with all that bubble stuff. What if we are right in front of one of those market crashes? You might be losing money for the next 3 years, and not break even for another 4. Yes, in the early 2000s, things hardly looked like they were going anywhere with two big crashes, but these charts are missing one important thing: dividends.

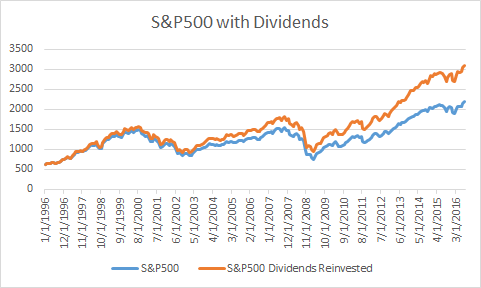

Vanguard has some charts to show you hypothetical growth, which include dividends. But it’s not easy to find a chart that compares S&P500 price growth with total returns. So for you my friend, I dug up the S&P500 data from this economist dude Rob Shiller’s website, and created an S&P500 chart that includes taking dividend payouts and reinvesting them.

A chart that shows the S&P500 with dividends re-invested.

I plotted out the last 20 years, and with dividends, things are starting to look better. With the compounding effect of reinvesting those payouts, you would have doubled your money in the last 10 years and nearly quintupled your money in the last 20 years. Yes, there are still dips, and they might even be painful, but it’s something you will have to tolerate. On a longer time period however, the trend is overwhelmingly positive.

That orange line is what professional investors like mutual fund managers are trying to beat, and the majority of them fail. Not only is buying an index an easy and lazy way to invest, it’s also very effective. Those mutual fund managers not only charge large fees, but often do a lot of trading, realizing capital gains, and sticking you with a large tax bill.

Save on taxes.

Index funds are very tax efficient because they only trade stocks as they enter and leave the minimum market cap. This means, when they are selling a stock, it’s on its way down, and in some cases the sale might even be at a loss. Usually any capital gains from selling can be offset with those capital losses. For this reason, the Vanguard Total Stock Market Index Fund has distributed zero capital gains to investors in over a decade. It’s almost like free built in tax loss harvesting as they sell the losers, and replace them with winners. So long as you leave the money invested, you only pay taxes on dividends, not growth.

Should I wait for another crash to invest?

You could, and many people are sitting on the sidelines waiting for one. But I can’t recommend trying to time the market. People felt the same way about the market a few years ago, and look at what they missed out on. Once you start sitting on the sidelines, you not only have to wait for the market to dip, but it has to dip low enough to make up for the dividends you missed out on. And given that the market returns are overwhelmingly positive, you are at a higher risk of ending up with less.

Bottom line is, the longer you are in the market the better. Looking at the chart, I can’t see any time in the past when it was bad to invest. I would invest now, even if it’s just a portion of your funds, and take note of the market value – let’s call this your stock market birthday. Once you make your initial investment, setup automatic monthly investments. That way you keep buying, and if the price goes down, you can celebrate getting shares on sale for less than your birthday price. And as long as you are working and buying, you should really look forward to market drops – it’s better to pay less for your shares. That just leaves more upside for you to enjoy when you retire one day.